Lower Your California Property Taxes

We expertly handle the appeal process to ensure significant savings and peace of mind.

Representation Success Rate

Team's Facilitated Refund

Average Tax Reductions

OUR CLIENTS SUCCESS STORY

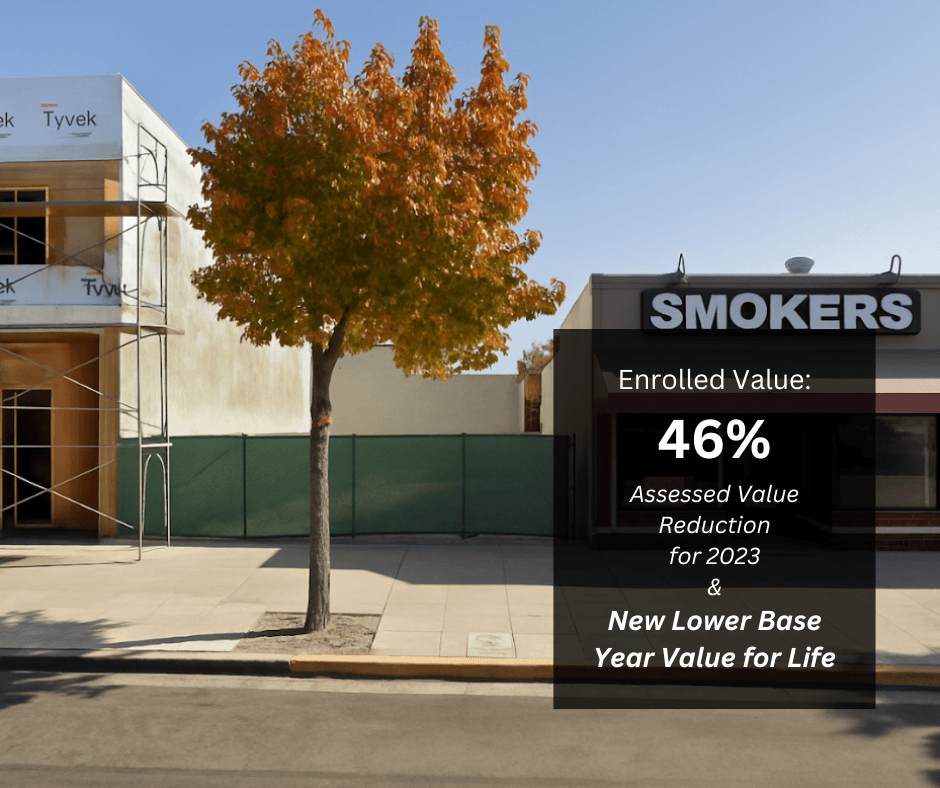

SAN DIEGO, CA

Vacant Commercial Lot – Change of Ownership Case

Challenges: In 2023, after a change of ownership, the assessor enrolled a new base year value 30% higher than the 2019 purchase price. This inflated valuation created a heavy tax burden on a vacant parcel that had not appreciated to that extent.

Solutions: We reviewed the assessor’s comparables and uncovered major flaws in their valuation approach. By presenting a detailed market study, we demonstrated that the true fair market value was actually 18% lower than the 2019 purchase price, proving their methodology unsound.

Results:

- 46% reduction from the assessor’s 2023 enrolled value

- New, lower base year value locked in for life

- Permanent property tax savings and stronger investment outlook

SAN DIEGO, CA

9 Unit HIGH-END APARTMENT BUILDING

Challenges: Very high property taxes enrolled on the improvements after completion of the new construction.

Solutions: We requested all the assessor’s work files to review for inconsistencies and found many. We then countered with a bulletproof analysis, capitalizing on the older Prop 8 value of the land, which pushed the market value of the improvements below actual construction costs.

Results:

- $84,000 refund for the year

- $22,000 annual savings for life

- Improved cash flow for investors

PALOS VERDES ESTATES, CA

Single family residence

Challenges: High property tax due to an unexpectedly high assessed value. The initial self-filed appeal was unsuccessful.

Solutions: We took over, filed a rebuttal, reviewed the assessment, coordinated with the assessor’s office, and used the sales comparison approach. Won the appeal and filed for a decline in value.

Results:

- $675,000 base value reduction, saving $7,500 for life

- Additional $200,000 reduction, securing a $1,800 refund

- Total refund of $9,300 for 2023

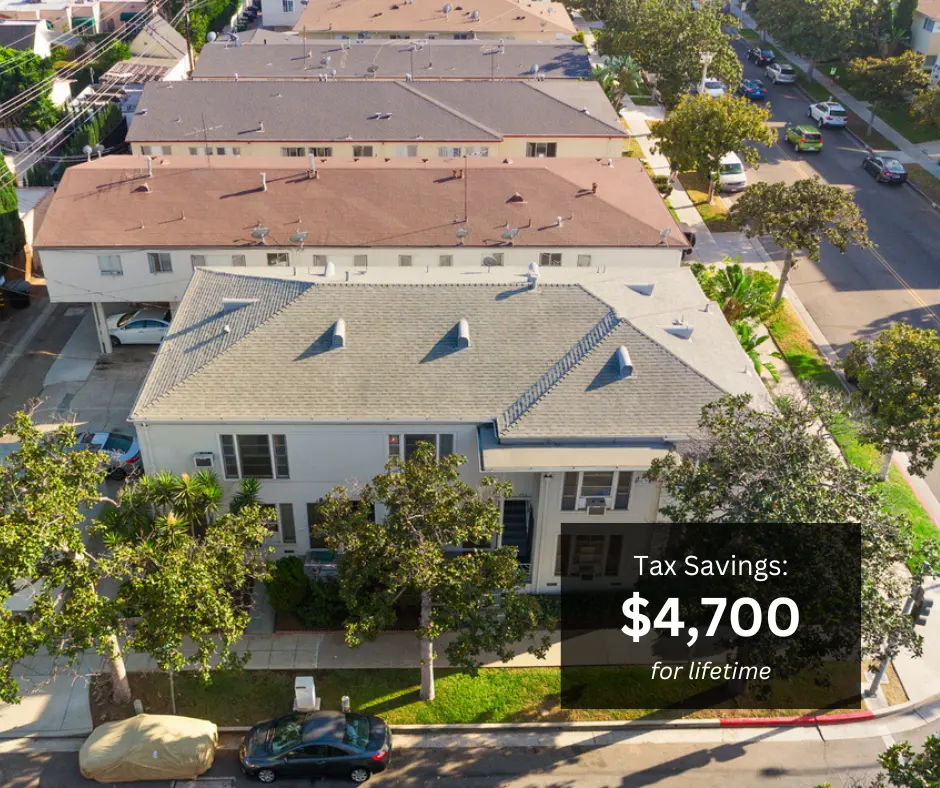

BEVERLY HILLS, CA

SIX-UNIT APARTMENT BUILDING

Challenges: During a 1031 exchange, the client faced tight deadlines and rising interest rates. An inexperienced broker agreed to an inflated sale price, and after purchasing the property, the client realized it was overpriced by about 20%.

Solutions: We reviewed the listing brochure, identified price inflation, and presented a 1031 duress case. Using the income approach and considering strict rent control policies, we effectively argued for a fair valuation.

Results:

- Base year value reduced from $2,860,000 to $2,500,000

- $4,700 lifetime savings

coronado, CA

single family residence (new construction)

Challenges: The client purchased a bungalow to construct their dream home and was concerned about potential property tax increases due to the new construction.

Solutions: Using Prop 19 tax transfer, we ensured no extra property tax increase. We collaborated with the assessor, shared construction cost details, conducted analyses, and presented comparable data. We advised the client on utilizing Prop 19 exclusion to transfer previous taxable value.

Results:

- No increase in property taxes due to new construction

- $26,500 tax savings for lifetime

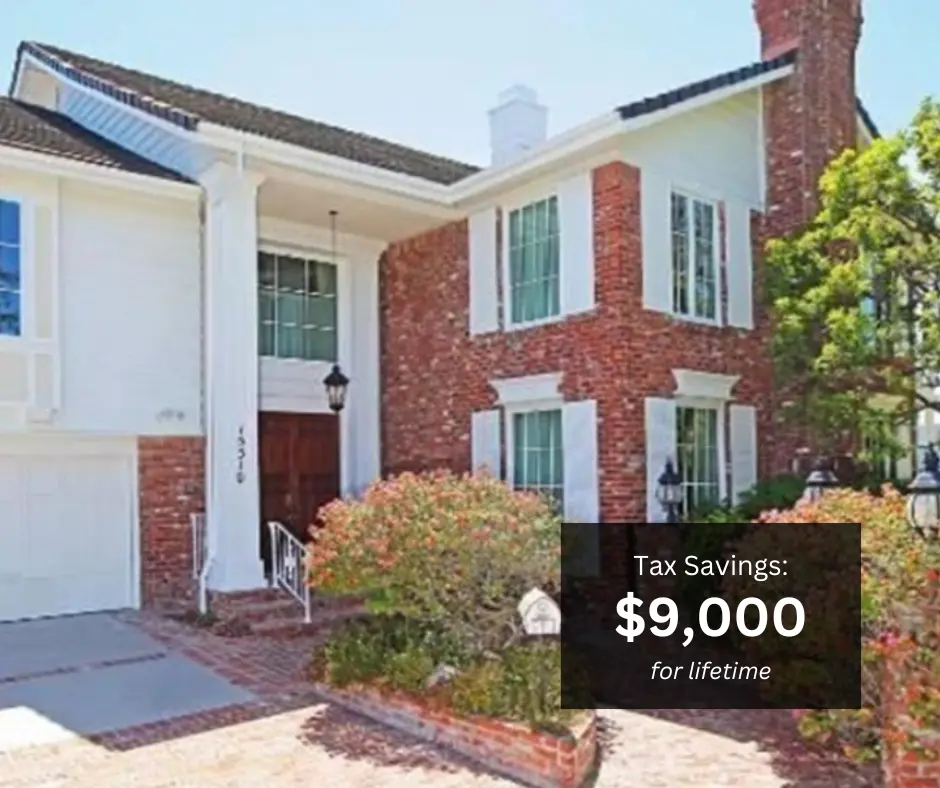

bel air, CA

single family residence

Challenges: The property, acquired through an off-market transaction, was assessed nearly 30% higher than its purchase price due to comparables from superior neighborhoods.

Solutions: We examined the assessor’s files, identified the flaw, and presented a comprehensive valuation report emphasizing comparables within the same neighborhood.

Results:

- Reduced assessed value by nearly 30%, aligning it with the actual purchase price

- $9,000 tax savings for lifetime

downtown los angeles, ca

commercial retail store

Challenges: The LA Assessor reassessed the property values based on a transfer between spouses, resulting in higher taxes dating back to 2018.

Solutions: We reviewed the reassessment, argued for community property status, and presented comprehensive legal and financial documentation. Through persistent negotiations, we convinced the assessor to revert to the original property values.

Results:

- Reversed all 2018 transfers, restoring the old assessed values

- Secured a $360,000 refund

brea, ca

commercial office

Challenges: The property was impacted by changes in the commercial market, leading to an inflated tax assessment.

Solutions: We conducted a thorough market analysis and provided evidence of the declining commercial market conditions. By presenting a compelling case to the assessor, we demonstrated that the property’s assessed value was overstated.

Results:

- Secured a $70,000 refund

5 ESSENTIAL STEPS TO SECURE YOUR PROPERTY TAX REFUND

Step 1

ASSESS YOUR PROPERTY

We start by conducting a detailed review of your property to identify opportunities for tax savings, setting a solid foundation for your appeal.

Step 2

ORGANIZE YOUR APPEAL

Next, we handle all the paperwork, submitting your appeal to the County Assessment Appeals Board to challenge your tax assessment officially.

Step 3

PREPARE YOUR CASE

Our experts prepare a solid case, utilizing detailed property valuations to build a compelling argument for your appeal.

Step 4

TAKE ACTION IN HEARING

We represent you at the hearing, advocating on your behalf to secure the best possible outcome and the maximum tax reduction.

Step 5

AWARD YOUR SAVINGS

Finally, we ensure your tax refund is processed and delivered to you, concluding our process with the savings you deserve.

WHAT ARE PEOPLE SAYING ABOUT US

Trustindex verifies that the original source of the review is Google. Anthony O'Connor knows his business. I consulted with him on a residential tax appeal and he quickly evaluated the situation and gave me specific next steps to take. It was easy to set up a virtual appointment through the website and send Anthony documents via the website. In addition to being highly competent, Anthony truly cared and took the time to elaborate and explain additional details and possible outcomes. Payment was also quick, fast, and processed via a secure website. All around it was an excellent experience.Trustindex verifies that the original source of the review is Google. Highly recommend Anthony at Aopta. Even though we didn’t end up working together he was very helpful. I appreciate that he took his time to answer questions and make the process easier to understandTrustindex verifies that the original source of the review is Google. Anthony went above and beyond to assist. He was patient and very informative in answering all our questions regarding a reassessment appeal. He saved us a lot of time and stress!Trustindex verifies that the original source of the review is Google. Anthony went above and beyond during our consultation call. I had a complex change of ownership and value assessment on my property. Anthony spent time before hand researching my property and documentation I sent him, then spent time with me during the consultation walking me through my options. We ultimately decided on a solution that I was more than capable of doing the paperwork for, and there was no pressure for his team to do the work. He did this all free of charge. 100% recommend reaching out to AOPTA for a consultation to see if there are any options to save on your property taxes.Trustindex verifies that the original source of the review is Google. Anthony is easy and friendly to work with. He takes the time to listen and really try to help. I appreciate that. Thank you!Trustindex verifies that the original source of the review is Google. Working with Anthony from AOPTA, has been great. His team is quick to respond and handles the process of claiming tax reduction seem simpler and less cumbersome.Trustindex verifies that the original source of the review is Google. I had a great experience with this company. He assisted me over the phone and went out of his way to do research—even during our very first call. His efforts and support were incredibly helpful in preparing me for my assessor meeting. I truly appreciate his help, and I’m hopeful that my upcoming assessment appeal will go well. Thank you!Trustindex verifies that the original source of the review is Google. I gotta say, Mr. Oconnor and the team at AOPTA are professional, kind, and most of all just easy to talk to. Before I found them, I called about 5 or 6 different attorney offices, public officials, and tax services. No one picked up it was either AI bots, voicemail, or some third-party companies trying to sell my info. Then I called AOPTA and within a ring or two, Anthony Oconnor picked up. Not ai, not an assistant or some person across the world from me, just a real person in Chula Vista ready to help. He knew a ton about reducing property taxes and answered all my questions about Prop 19. He also had a very good understanding of how the city works. he knew exactly who to contact and how to get things done. What would’ve taken a law office weeks to figure out, he explained in a simple 15-minute phone call. There’s a reason he’s saved in my phone as “The Property Tax Man.” I seriously can’t recommend this team enough—they actually care, and that’s super rare these days.Trustindex verifies that the original source of the review is Google. Excellent experience! Highly recommend.Trustindex verifies that the original source of the review is Google. Anthony is super helpful for all your real estate property tax questions. He helped save me $$$. Don’t hesitate to call if you have any questions.Google rating score: 4.9 of 5, based on 36 reviewsVerified by TrustindexTrustindex verified badge is the Universal Symbol of Trust. Only the greatest companies can get the verified badge who has a review score above 4.5, based on customer reviews over the past 12 months. Read more

Received our letter?

Your potential savings are just a click away. Start your property tax appeal now and make the most of this opportunity.

OUR RECENT BLOGS

Do you want to know if you are eligible for a property tax reduction?

Let our property tax appeal experts review your property.

get in touch

Your First Step Towards Fair Property Tax Assessments

Facing challenges with your property tax assessment can feel overwhelming, but you’re not alone. Our expert team is here to guide you through the appeal process with ease and confidence.

Share Your Concern: Drop us a message detailing what’s happening with your property tax. Be as specific as you can to help us understand your situation.

Expert Consultation: One of our Property Tax Experts will get back to you shortly to gather more details and assess your case. This initial consultation is crucial for crafting a tailored approach to your appeal.

Strategic Representation: Based on our discussion, we’ll offer advice on the best course of action. Should you choose to have us represent your appeal, we’ll work diligently to secure a positive outcome, aiming for the fair assessment and savings you deserve.